Atomic Outlook

back to contentsIn October, the International Atomic Energy Agency (IAEA), the International Energy Agency (IEA) and the US Energy Information Administration (EIA) each released their energy market outlooks. These organizations acknowledge nuclear power as a low-carbon energy source alongside renewable energy generation. However, predicting the scale of nuclear additions remains a challenging task. All the three outlooks cover the period till 2050, with energy accessibility and carbon neutrality seen as the main challenges. The authors of the three reports also share the idea that electricity generation and consumption will grow and electricity will increase its share in the total energy consumption.

Future Indefinite

Overall, high uncertainty about the future is mentioned in two out of the three outlooks. The authors from the IAEA admit that their projections do not fully capture all the factors affecting reality: “The low and high estimates reflect contrasting, but not extreme, underlying assumptions about the different driving factors that have an impact on nuclear power deployment. These factors, and the way they might evolve, vary from country to country. The estimates presented provide a plausible range of nuclear capacity development by region and worldwide. They are not intended to be predictive nor to reflect the whole range of possible futures from the lowest to the highest feasible.”

The authors of the EIA outlook give even higher estimates of the uncertainty: “Unmodeled surprises or breakthroughs that shift the trajectory of the global energy system will almost certainly happen. As Yogi Berra quipped, ‘The future isn’t what it used to be.’ So, our modeled cases should not be interpreted as forecasts. Rather, IEO2023 provides a useful benchmark for decision makers around the world as they continue to shape our collective energy future.”

The authors of the IEA outlook show more confidence in the future. They developed three scenarios, one of which is believed to come true. Uncertainties are explored: “Our analysis explores some key uncertainties, notably regarding the pace of China’s economic growth and the possibilities for more rapid solar PV deployment opened by a massive planned expansion in manufacturing capacity (led by China) <…> We examine how any deterioration in geopolitical tensions would undermine both the prospects for energy security and for rapid, affordable transitions.”

Approaches to data interpretation are also different. The EIA structures data as a probability framework with benchmarks in the middle. “IEO2023 represents a set of policy-neutral baselines that focus on the current trajectory of the global energy system,” the document reads. The IAEA traditionally presents two — high-case and low-case — scenarios, while the IEA considers three, the Stated Policies Scenario (STEPS), the Announced Pledges Scenario (APS), and the Net Zero Emissions by 2050 (NZE) Scenario.

The most important difference, perhaps, is that the outlooks by the IAEA and the EIA establish some options of future developments. The outlook by the IEA is a persistent and repeated recommendation for certain actions: “The key to an orderly transition is to scale up investment in all aspects of a clean energy system <…> But the urgent challenge is to increase the pace of new clean energy projects, especially in many emerging and developing economies outside China, where investment in energy transitions needs to rise by more than five times by 2030 to reach the levels required in the NZE Scenario.” It is unclear, though, why developing economies are obliged to harmonize their energy and, most importantly, financial policies with the targets from the IEA experts.

Nuclear future

Interest in nuclear energy has grown. “In light of this evolving energy landscape, with strong commitment to climate action and renewed scrutiny of energy supply security, a number of Member States have revised their energy policy towards nuclear, leading to decisions for the long term operation of existing reactors and new construction of Generation III/III+ designs. There has been also an acceleration in the interest and the development of small modular reactors in a growing number of countries targeting both electric and non-electric applications,” the IAEA projection says.

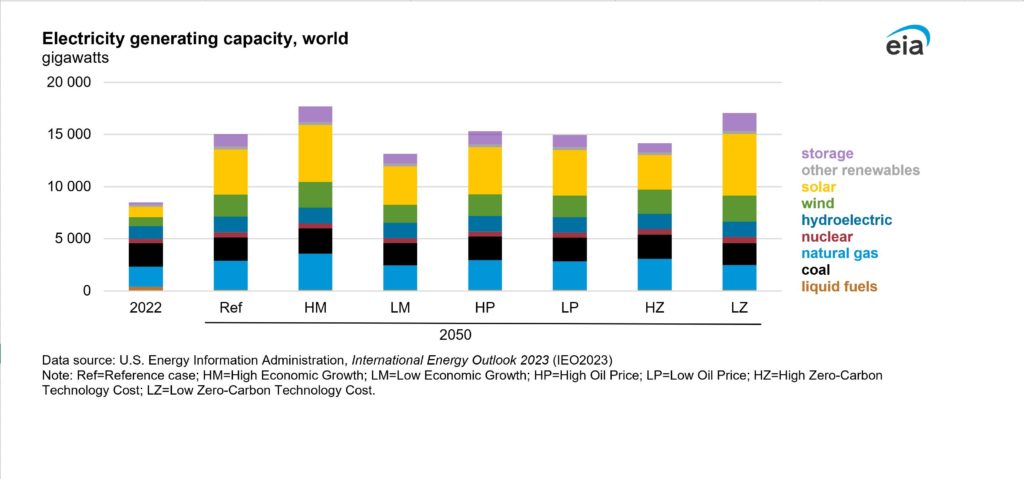

Specific figures on the installed nuclear capacity differ, however. The outlook by the EIA is the most skeptical: “Nuclear capacity is stable in most cases except the Low ZTC (Low Zero-Carbon Technology Cost — RN) case, where we eased noneconomic constraints (that is, geopolitical considerations) to explore the economic effects on nuclear builds. In this case, nuclear capacity increases by 194 GW in 2050 relative to the 2022 capacity of 400 GW.”

According to the IAEA, the low case projections indicate that the world nuclear capacity will increase modestly to 458 GWe. In the high case, the world nuclear capacity is expected to more than double to 890 GWe by 2050. As of late 2022, the total nuclear capacity worldwide was 371 GW (370.17 GW as of late October 2023, according to PRIS). Compared to the previous year, the IAEA raised its low-case estimate by 14 % and the high-case estimate by 2 %.

In the high case, the total nuclear electrical generating capacity is projected to increase globally by about 24 % by 2030 and increase by about 140 % by 2050 compared to the 2022 capacity. In the low case, nuclear electrical generating capacity is projected to increase by about 9 % by 2030 and then increase by about 23 % by 2050.

In the low case, the share of nuclear in total electrical generating capacity is projected to decrease by 2050. A reduction of about 1.7 percentage points is expected. In the high case, the share of nuclear in total electrical generating capacity is expected to increase by about one percentage point by 2050.

Different sections of the IEA outlook provide varied estimates. According to one of the estimates (p. 106), “the share of nuclear power remains broadly stable over time in all scenarios.” According to another (p. 126), “nuclear power capacity increases from 417 GW in 2022 (sic!) to 620 GW in 2050 in the STEPS.” The authors believe that the reactor life extensions and new additions will increase the installed nuclear capacity to 770 GW by 2050 in the APS and 900 GW in the NZE Scenario. As mentioned in the outlook on page 126, “nuclear construction reaches new heights.”

Be that as it may, the twofold difference in the outlook is large and also points to high uncertainty.

The EIA and IEA outlooks include nuclear among the low-carbon energy sources, which also comprise renewable energy generation and fossil fuel generation with CO2 capture and disposal. As noted in the IAEA projection (with reference to the IEA data), nuclear generation has prevented the emission of about 70 billion tonnes of carbon dioxide over the past 50 years.

Challenges to implementation

The IEA outlook structures the risks inherent in different energy sectors. As for nuclear power, risks associated with obtaining permits and certificates, lack of qualified personnel and the cost of financing are considered to be high. This is not the largest set of risks as, for example, four risks were named for each of wind power and power grids.

The challenges listed by the IEA overlap with those identified by the IAEA, such as financing, economic difficulties and supply constraints for new construction. “In recent years, construction cost overruns and delays for first of a kind projects have led to high project risk perception in the Americas and Europe, hampering investment decisions for new projects,” the IAEA projection says. However, its authors promptly specify that nuclear power units in other regions are built according to the estimates and within the time-frames established. Efforts are also made towards regulatory and industrial harmonization, as well as progress with final disposal of high-level radioactive waste.

Regional aspect

The authors of the IEA and EIA outlooks do not delve into the specifics of the nuclear industry in different regions, so the information presented below is taken from the IAEA projection.

In North America, the high scenario sees the total installed capacity growing by 44 % to 156 GW by 2050, while the low scenario provides for a downfall by a third from its current level to 67 GW. In the high scenario, power production at nuclear power plants will grow by about one and a half times from the 2022 level to reach 1,297 TWh by 2050. In the low scenario, the electricity output will fall by a third to 547 TWh. The share of nuclear can rise by 1.5 — or fall by 9 — percentage points (pp.) by mid-century.

In Latin America, where hydropower has always had a strong foothold, nuclear power plants appeared first in the 1970s. Since then, the share of nuclear has quadrupled but remains modest at about as little as 2 % of the energy mix. The high scenario sees the installed nuclear capacity growing fivefold to 25 GW by 2050, while roughly doubling (to 12 GW) in the low scenario. Nuclear generation will grow sixfold to 197 TWh, or 30 % to 92 TWh, in the high and low scenarios, respectively. The share of nuclear in the total installed capacity will either grow by 1.6 pp. or remain unchanged; the share of nuclear in electricity generation will triple or grow at a much more modest pace.

In Western, Northern and Southern Europe, the share of nuclear doubled between 1980 and 1990 and then declined to make 19 % now. The installed nuclear capacity in the region will be declining until 2030 in the both low-case and high-case scenarios. Then it will grow by a third from the 2022 level to 131 GW in 2050 in the high scenario or fall by 40 % to 60 GW. Nuclear generation will either grow by 91 % to 1,075 TWh (up 11 pp.) or decline by about 12 % (more than 5 pp.) to 493 TWh by 2050.

In Eastern Europe, the share of nuclear has quadrupled since 1980 to 23 % as of 2022. The high scenario expects the installed nuclear capacity to almost double from the current levels to reach 102 GW by 2050, while growing by as little as 11 % to 59 GW in the low-case scenario. The share of nuclear generation will grow by 6 pp. to 800 TWh or fall by 1.5 pp. to 461 TWh, respectively.

In Africa, nuclear accounted for about 2–3 % of the total power output in 1990–2010. Since then, its share has fallen to 1.2 % due to an increase in other types of generation, primarily gas and hydropower. Electricity consumption on the continent is expected to quadruple by 2050 vs. 2022. Africa’s nuclear generating capacity is projected to grow more than tenfold to 20 GW by 2050 in the high scenario and fivefold to 9 GW in the low scenario. In the high scenario, nuclear power generation is seen to grow more than 14 fold to 144 TWh by 2050, with its share tripling. In the low scenario, it will increase sevenfold to 69 TWh, and its share will grow to 2 % of the total power production.

West Asia has traditionally used a lot of oil: fossil fuels have accounted for about 80 % of the total energy consumption for more than 40 years. Electricity generation has grown 13 times over the same period. The share of nuclear in the total electricity generation was 1.7 % in 2022. The high scenario sees it growing fivefold to 24 GW by 2050. In the low scenario, the share will triple to 14 GW. At the same time, power generation at nuclear power plants will grow more than eightfold (by 5 pp.) to 189 TWh in the high scenario and fivefold (by 2 pp.) to 112 TWh in the low scenario.

In South Asia, nuclear generation accounted for 3 % of electricity output in 2022, with coal being the primary source of energy in this region, followed by gas. The electricity generation will more than triple by 2050. The high scenario expects nuclear capacity to grow more than sevenfold to 74 GW by 2050 and the share of nuclear in the total energy mix to reach 2.5 %. In the low scenario, nuclear capacity will quadruple to 42 GW, and the share will decrease to 1.4 %. Nuclear power generation in the region will increase eightfold (by 5 pp.) to 578 TWh in the high scenario and fivefold (by 1.5 pp.) to 331 TWh in the low scenario.

In Central and East Asia, the share of electric power had more than doubled since 1980 to over a quarter of the total energy consumption in 2022. The share of nuclear in the total electricity production had grown until 2000 and then declined to about 6 % in 2022. The high scenario assumes that the installed nuclear capacity in the region will quadruple (grow by 4 pp.) to 345 GW by 2050, while the low scenario assumes its doubling to 192 GW. The share of nuclear in this case will grow from the current 2.8 % to 3.6 %. Power production in the high scenario will increase 4.5 times (by 11 pp.) to 2,777 TWh by 2050, while in the low scenario it will increase by almost 280 % (by 5 pp.) to 1,772 TWh.

In Southeast Asia, electricity generation has quadrupled since 1980. There are no nuclear power plants in the region yet. The main energy sources are coal, gas and hydropower. The region is expected to build 11 GW of nuclear capacity in the high scenario and 3 GW in the low scenario. Nuclear power plants will generate 87 TWh and 24 TWh of electricity in the high and low scenarios, respectively.

Oceania does not yet have nuclear capacity either. Electric power is mostly generated with coal. The high scenario expects 2 GW of nuclear capacity to be built in the region by 2050. There will be no new construction in the low-case scenario. Accordingly, nuclear generation will either reach 14 TWh per year or remain at zero.

For its part, Rosatom makes a huge contribution to the development of nuclear generation around the world. Following 2022, the Russian nuclear corporation remains the largest player in the international market. Rosatom is building 32 power units in seven countries, with a total of 33 units in 11 countries in the pipeline. For 18 years since the foundation, Rosatom has built 18 large power units (excluding the floating nuclear power plant), with nine of them constructed outside Russia.