African Interest

back to contentsIn August, the IAEA released its Outlook for Nuclear Energy in Africa. The report outlines the current state of the energy sector (including nuclear) on the continent, assesses African countries’ contribution to global uranium production, describes the key challenges facing plans to deploy nuclear capacity, recommends mechanisms that could assist in this effort, and provides a positive example — the El Dabaa Nuclear Power Plant being constructed by Rosatom in Egypt.

Electricity shortage and uranium availability

Most African countries face a severe shortage of electricity. Around half a billion people have no access to electric power at all. Electricity is generated primarily using fossil fuels.

Africa’s main contribution to nuclear energy is uranium mining. Namibia accounts for 11.34% of global natural uranium concentrate production, Niger for 4.08%, and the Republic of South Africa for 0.4% (the IAEA cites data for 2022).

One example mentioned in the report is the Mkuju River project developed by Mantra Resources (controlled by Rosatom). This project is located in Tanzania; its identified resources amount to 58,500 tonnes of uranium. In 2020, the company decided to build a pilot processing facility to begin trial operations using open-pit mining and in-situ leaching methods. By 2022, Mantra Resources had obtained all necessary construction permits, with construction completed and equipment installed by 2023.

The news that did not make it into the report is that Mantra Resources commissioned its pilot facility late this July. The facility will test uranium processing methods and, if necessary, develop optimization solutions. The collected data will inform engineering decisions for the main processing plant with a production capacity of up to 3,000 tonnes of uranium per year. Construction of the main plant is scheduled to begin in the first quarter of 2026, with commissioning planned for 2029. The project is expected to create over 4,000 new jobs in the mining sector and related industries during the construction and operation phases. The project is also expected to contribute to the development of regional infrastructure, including the road network in the Namtumbo region.

Nuclear power plants: reality and prospects

South Africa is currently the only country on the continent generating nuclear electricity. The first and second units of the Koeberg Nuclear Power Station with a combined electrical capacity of 1,854 MW were launched in 1984 and 1985, respectively.

Many African countries have expressed interest in developing nuclear power generation, but these plans are at different stages of implementation. Namibia, Togo, Burkina Faso, and other countries — nine in total — are at the earliest stage, Pre-phase 1.

Algeria, Ethiopia, Morocco, Niger, and several others — ten countries in total — have begun necessary discussions prior to deciding to launch a nuclear power deployment program. IAEA experts refer to this stage as Phase 1. Ghana, Kenya, and Nigeria are in Phase 2, preparing to sign contracts and begin construction after key decisions have been made.

Phase 3 means that activities related to implementing the first nuclear generation project are completed. Only one country in Africa — Egypt — is at this stage. Its activities in the nuclear sector are cited in the IAEA report as a success story.

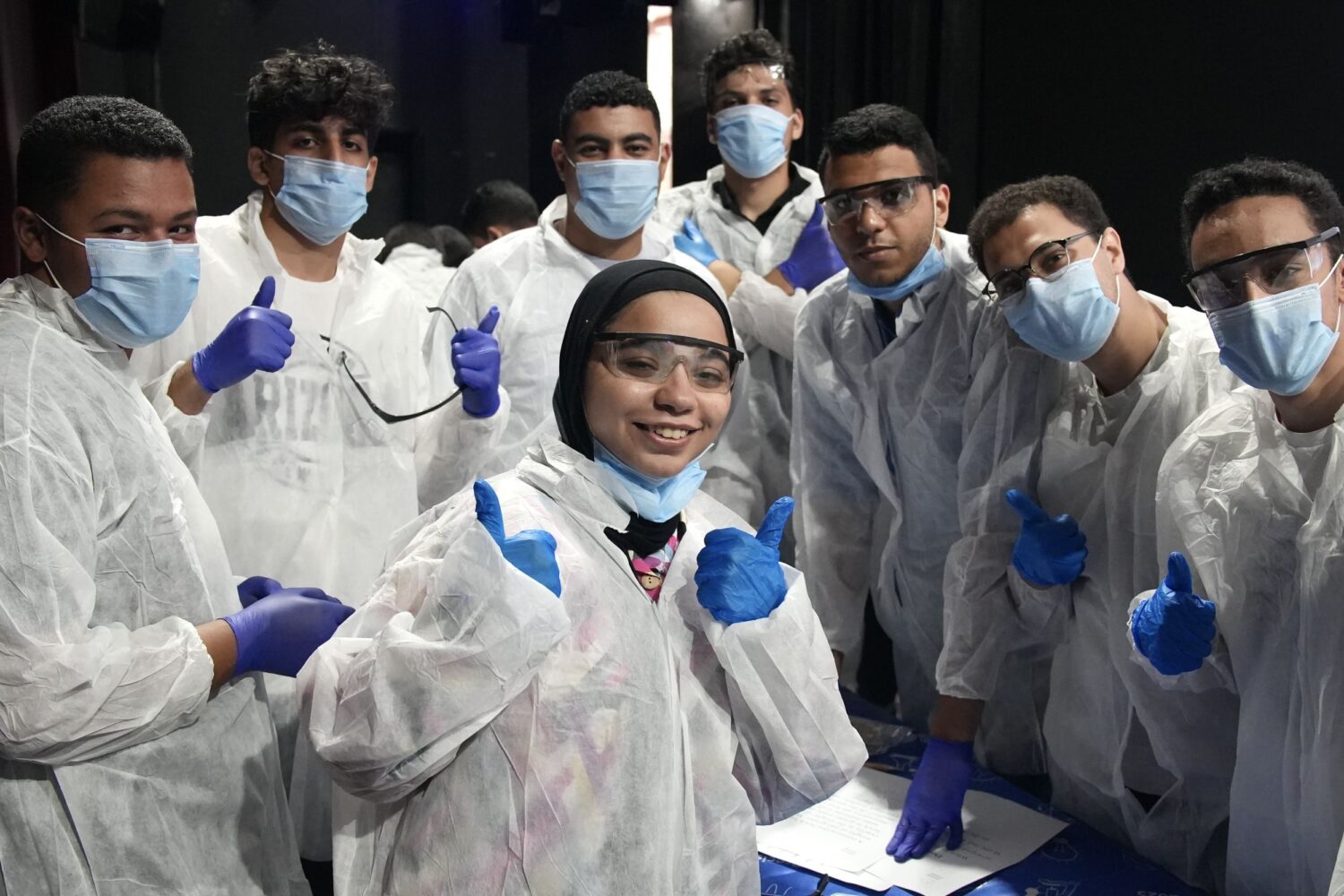

Egypt is the only country in Africa where a nuclear power plant is currently under construction. This is the four-unit El Dabaa Nuclear Power Plant with VVER-1200 reactors, being built by Rosatom. Upon completion, it will be the largest and most powerful nuclear power plant in Africa, with a total capacity of 4.8 GW. It is expected to meet about 10% of the country’s energy needs. The project has already created thousands of jobs, contributing to the development of nuclear science, engineering expertise, and workforce competencies in the country.

Egypt is cooperating with the IAEA as part of the El Dabaa construction project. The country has hosted several IAEA peer review missions, including the Integrated Nuclear Infrastructure Review (INIR) mission, a site and external events design (SEED) mission, and a technical safety review. The parties plan to conduct additional missions and activities before the first unit enters commercial operation.

Overall, the total power generation capacity in African countries is projected to increase by 47% by 2030 and nearly sevenfold by 2050, according to the report. In the optimistic scenario, nuclear generation capacity is expected to grow by more than three times by 2030 and over tenfold by 2050, compared to the total nuclear capacity in 2022. In the pessimistic scenario, nuclear capacity will approximately double by 2030 and increase fivefold by 2050 compared to the 2022 level. However, it should be understood that such high figures are a result of a low base effect.

By 2050, power generation capacity in Africa could grow nearly sevenfold, and nuclear generation capacity more than tenfold, according to the IAEA.

Challenges and solutions

The desire of African governments to deploy nuclear capacity faces a number of challenges of various kinds.

A technical challenge is that local power grids are unprepared to integrate large-capacity nuclear power plants. In the report, agency experts suggest considering small modular reactors (SMRs). “As nuclear technology evolves, African countries with small electrical grids or smaller economies can consider SMRs, as this technology promises smaller amounts of upfront capital, smaller electrical output and quicker deployment, which make the SMR technology ideal for most of these countries,” the report says.

However, the authors of the report believe there are currently no commercially viable offers in the SMR segment. Yet it should be recalled that the world’s first export contract for the construction of an SMR nuclear power plant with RITM-200 reactors has already been signed: Rosatom and Uzbekistan concluded it in May 2024. Moreover, Rosatom is actively discussing the construction of SMRs with various, including African, countries.

The most critical challenge to building nuclear power plants — even small ones — in African countries is the lack of financing. According to the estimates by IAEA experts, achieving even the pessimistic scenario targets would require over USD 100 billion. A successful example of financing a nuclear power plant in an African country is, once again, Egypt’s El Dabaa NPP. “Similar to other nuclear power projects in other emerging markets and low to middle income countries, Egypt’s El Dabaa project receives significant concessional loans from its supplier, the Russian Federation, with a favorable interest rate and a favorable repayment period. Such vendor financing, if available, would further the development of nuclear energy in African countries, where both clean energy and climate investment are much needed,” the report says.

The IAEA also places great hope on cooperation with the World Bank. On June 26, 2025, the agency and the World Bank Group formalized a partnership supporting the safe, reliable, and responsible use of nuclear energy. Under the partnership, the World Bank intends to contribute to extending the service life of existing nuclear power units and support the modernization of power systems and associated infrastructure. It will also work to increase the potential of small and medium-sized reactors. “The agreement will alter and influence the influx of direct financial resources into the nuclear power sector. The agreement could also serve as a catalyst for broader engagement by other multilateral banks opening new avenues for African countries to access financing for their nuclear power programs. This would make more resources available to fiscally constrained economies in Africa to finance nuclear power programs,” the report notes.

The IAEA also proposes several ways to reduce costs and share risks. One of them is creating an ‘order book’ for SMRs. The essence of this solution is to form a consortium of potential consumers who would guarantee electricity sales. Reliable offtake would improve project feasibility and attract financing and professionals from multiple sources while sharing risks among stakeholders.

A second option is to involve mining companies in financing, as they traditionally act as major electricity consumers and have a strong interest in reliable power supply for their operations.

“As African countries experience rapid population growth and industrialization, nuclear energy is increasingly viewed not only as a reliable and low-carbon solution but also as a means of supporting socioeconomic development and long-term energy independence,” the authors of the report believe. The IAEA offers various forms of expert support that could help accelerate the implementation of nuclear energy projects in African countries.

Matra Tanzania, Wikipedia, “Strana Rosatom” Newspaper, ASE EC (Atomstroyexport)