The Future of Small Modular Reactors

back to contentsMedia outlets around the world are quoting at length from the report “Scaling Success: Navigating the Future of Small Modular Reactors in Competitive Global Low Carbon Energy Markets” released last December by the New Nuclear Watch Institute, a British think tank. The authors conclude that Russia will take a leading position in the SMR market.

Subject of assessment

One of the sections of the report is dedicated to assessing and comparing the economic parameters of large and small nuclear power plants. This projection is founded on “baseline assumptions and the model put forward by the UK government in the Small Modular Reactor Techno-Economic Assessment”. NNWI evaluates some “generic SMR” technology from aggregated project materials submitted by anonymous vendors to the UK government to obtain public support. The 2010 average in British pounds was then adjusted to 2023 in US dollars. In particular, the cost of constructing 1 kW of nuclear power plant was estimated at USD 7,500/kW.

The authors of the report sought to find out under which conditions the cost of building 1 kW of small-scale nuclear generation would be comparable to that of a large nuclear power plant. They took USD 7,500/kW for an SMR and USD 5,500/kW for a large NPP as a baseline.

However, the 2020 edition of the Projected Costs of Generating Electricity joint report by the International Energy Agency (IEA) and the Nuclear Energy Agency (NEA) says the overnight costs ranged from USD 2,157/kW in South Korea to USD 6,920/kW in Slovakia. The overnight costs for the US were USD 6,041/kW, according to the IEA 2020 report. Considering that more or less known data for different large scale projects differ by more than three times, it must be taken into account that the report data is averaged and cannot be directly used to estimate the cost of a particular project. This is especially important for assessing projects with RITM reactors of various modifications, because their specifications were not used to determine average characteristics.

The authors of the report, comparing different types of nuclear power plants, come to the conclusion that the cost of constructing an SMR will be equal to that of a large nuclear power plant in the best case after the construction of 20 units, in the basic and worst case — after 70–90.

Perhaps, we can say that Russia has already completed part of this journey (half in the best-case scenario): Rosatom enterprises have already manufactured 10 RITM 200 reactors for Atomflot.

The Market Share

The executive summary at the beginning of the report reads: “The Russian RITM reactor family, capitalizing on government support and an integrated ‘plant-as-a-service’ business model, including spent fuel and waste management, is set to dominate the off-grid segment of the global SMR market, becoming the most common installation worldwide. The Chinese ACP100 or Linglong One is projected to follow, capturing about 15 % of the global SMR fleet by installed capacity». NuScale’s VOYGR is likely to secure 5–10 % of the world’s installed SMR capacity in 2050. Amongst advanced reactors, which are set to be deployed in series around 2040s, the US XE 100 appears to have the highest chances to capture the largest market share of 7 % of global installed capacity.”

Since other projects are not named in the report and Russian reactor technologies are the only ones whose share is not explicitly stated, the comparison of names and figures seems to suggest that small-scale nuclear power plants with RITM reactors will account for at least 68 % of the small-scale nuclear generation market.

Since other projects are not named in the report, and Russian reactor technologies are the only ones whose share is not directly stated, one would like to think that the share of SMR NPPs with RITM reactors will account for at least 68 % of the market. However, the text below suggests that in 2030 Russia will account for 20–25 %. At the same time, the shares of China and the United States will be approximately the same.

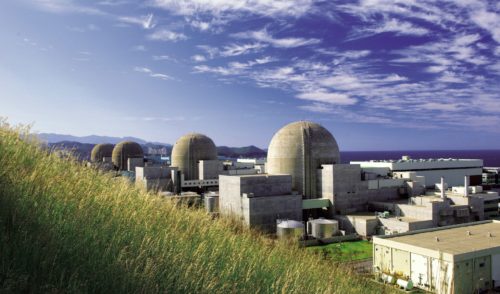

Regardless of the UK study, it should be noted that Rosatom is currently an indisputable leader of the global SMR market. Akademik Lomonosov is still the world’s only floating nuclear power plant. Project 22220 icebreakers are equipped with RITM 200 reactors. Three such icebreakers are already in operation on the Northern Sea Route, and another three are under construction.

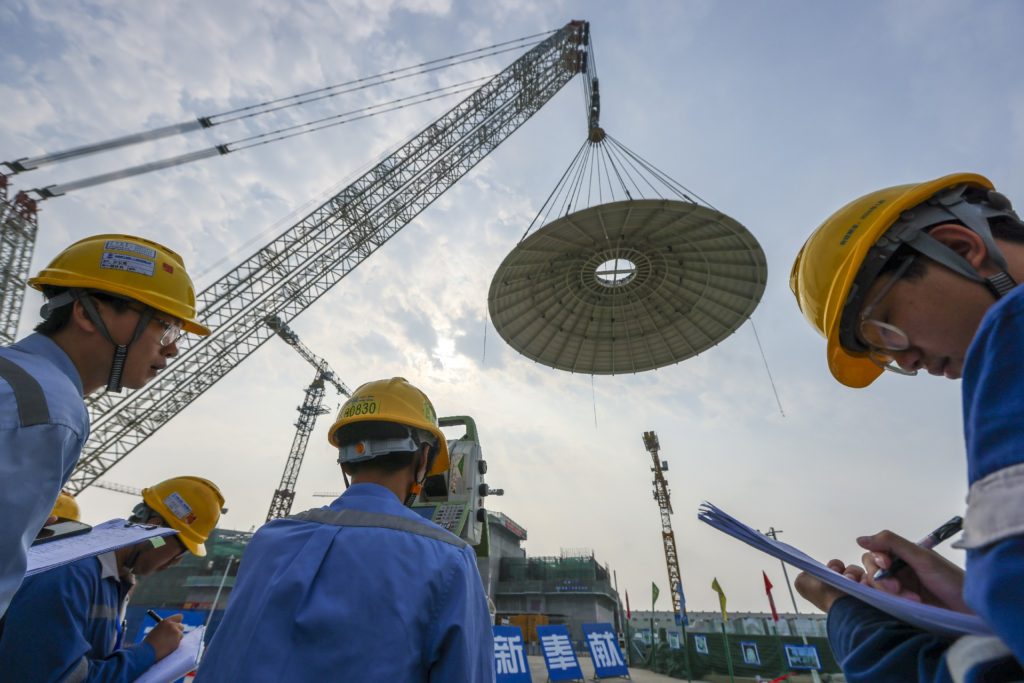

Rosatom Group companies are developing ten advanced designs of small and micro reactors. For instance, equipment is being manufactured for new floating power units that will supply electricity to the Baimsky GOK mining site. Production of components for an onshore SMR to be built in Yakutia has also begun. Those floating power units and the onshore SMR will be equipped with different modifications of the RITM 200 design.

RITM 400 reactor will be installed on the world’s most powerful icebreaker Rossiya (Leader project). Russian mining giant Nornickel and Rosatom are discussing the construction of an onshore SMR with the same reactor design.

Construction of RITM-based offshore and onshore small-scale nuclear power plants of various capacity and modifications is also being discussed with potential foreign customers.

A pilot power production facility with BREST-OD 300 reactor is being built apace (for more details see our article “BREST Gets Based”). A decision was made to build an SMR with SHELF-M micro reactor to supply power to the Sovinoye deposit in Chukotka. Its technical design is expected to be ready later this year, with on-site preparations to begin next.

Three lead-bismuth designs (SVET-M, SVGT 1 and SVBR 100), a pressurized water VVER-I reactor, a HTGR-based nuclear power plant, and a thermoelectric conversion reactor Elena-AM are at an earlier stage of development.

In addition, Rosatom is working on two research reactor projects (according to the IAEA, they cannot be classified as SMRs). One of them is MBIR, a fast neutron research reactor, which is already under construction. The other, a molten salt research reactor, is at the concept design stage. Its technical design is expected to be completed in 2025. The two reactors will be used to conduct research to develop solutions for closing the nuclear fuel cycle.

Returning to the report: unfortunately, an error was made: “By 2025, Russia is likely to have about 1 GWe of SMR capacity operating in the closed nuclear fuel cycle. However, it is unclear whether the SMR concept will be central to Russia’s fuel cycle closing strategy.” Apparently, there was a typo and the year 2035 was meant, but even in this case it is not entirely clear which SMRs are meant.

Fragmentation

The authors of the report note an important trend emerging in the global nuclear market — division into spheres of influence. One of the sections of the report highlights two blocks. The first is the Sapporo 5 (named after the place where the United States, Canada, France, the United Kingdom and Japan agreed to cooperate in the manufacturing of nuclear fuel), their allies from the OECD countries and other countries. The second is the BRICS countries and countries inclined to cooperate with Russia and China, the key players in the SMR segment. The authors of the report note that Russian and Chinese SMRs are unlikely to be subject to sanctions risks, since they will not contain components subject to sanctions risks. All while such projects can be financed outside the dollar and euro systems.

The authors of the report note that the Rosatom SMR export offer is beneficial for potential clients thanks to the service for exporting spent nuclear fuel back to Russia for reprocessing. Rosatom views spent nuclear fuel not as a waste, but as a valuable source of fissile materials suitable for reuse. This concept allows clients to save money on creating their own processing facilities. And, we note, it increases the public acceptance of nuclear projects with the participation of Rosatom.

Overall, Rosatom is doing a lot of work to promote its reactor technologies on the Russian and the global markets in various ways in order to reduce risks and make SMR projects implementable at specific sites.