Rare Earth Supply Chain

back to contentsRosatom is building an end-to-end production and supply chain in the rare earth sector, from ore mining to final products such as wind turbines and electric cars. Here is the story of how the entire chain works.

Located in Russia’s northwestern region of Murmansk, the Lovozero Mining and Processing Plant (part of Rosatom’s mining division) produces loparite ore. Loparite is a mineral containing titanium, tantalum, niobium, and rare earth elements (REE). The Lovozero MPP is Russia’s only producer of REE-containing concentrate, which is then shipped to the Solikamsk Magnesium Plant (SMP) in the Urals.

The production at SMP is arranged to allow for the fullest use of commercial components contained in feedstock materials. When SMP produces magnesium, which is its primary product, it also obtains chlorine as a byproduct. Chlorine is used to treat loparite concentrate and extract rare earth elements. The resulting rare earth chlorides then pass several processing operations to be turned into a mixed rare earth carbonate, which is exported so far. SMP has already taken steps to set up a separation process in house and produce individual compounds of cerium, lanthanum, neodymium, praseodymium, and concentrates of middle rare earth elements (samarium, gadolinium, and europium).

Saint Petersburg-based company Rusredmet has built a pilot separation plant for mixed rare-earth concentrates on commission from SMP. The process flow is as follows: the mixed concentrate is dissolved in nitric acid. The resulting nitrate solution is electro-oxidized to extract first cerium and then other elements. The extraction is followed by precipitation, drying and annealing. The separation plant is expected to be put in operation in 2026.

Its planned capacity is 2,500 tonnes of cerium, lanthanum, neodymium and praseodymium compounds per year. Of these, 18 % (450 tonnes) will be neodymium and praseodymium oxides, which is equivalent to 370 tonnes of metal. The individual compounds obtained will be used in various industries, particularly in glass-making, metallurgy and production of catalysts.

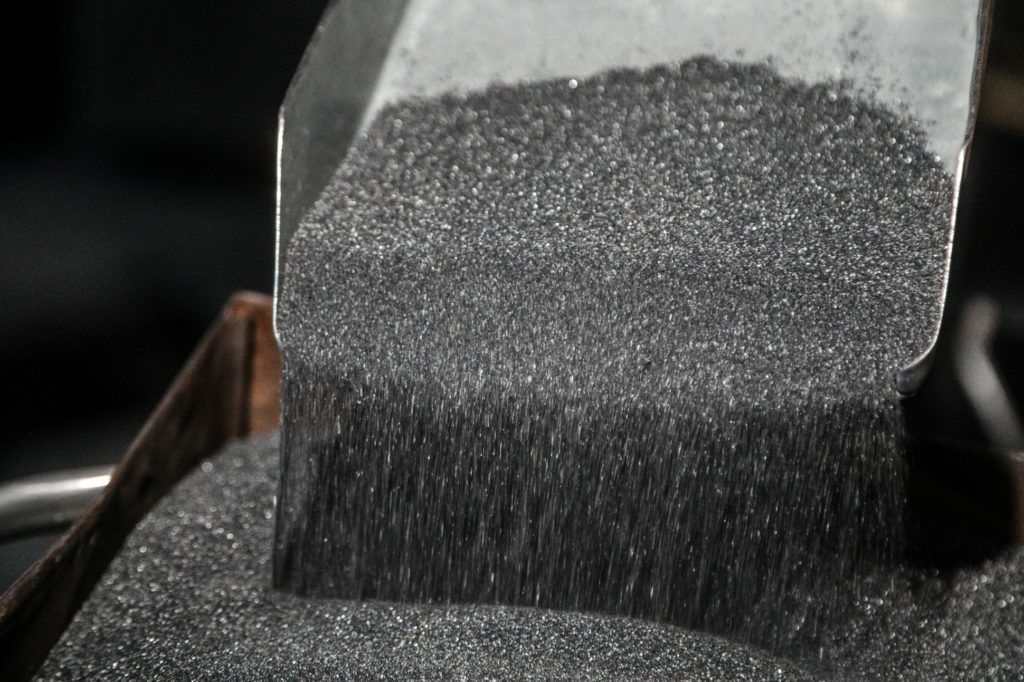

Another REE consumer industry should soon appear in Russia through Rosatom’s efforts. This will be the production of permanent rare earth neodymium-iron-boron (NdFeB) magnets, in which neodymium and boron account for about half of the mass. According to the International Renewable Energy Agency (IRENA), production of rare-earth magnets consumed 29 % of global REE supply in 2022.

Rusatom MetalTech (part of Rosatom’s fuel division) is developing engineering documents for the first 1,000 tonne production line. The NdFeB magnet plant will be launched in Glazov (Russia) in 2028. With the second production line installed, the plant’s capacity will increase to 3,000 tonnes of permanent magnets per year. This quantity will be enough to almost fully meet the needs of key Russian industries for these products.

According to analysts, the rare-earth magnet production market is now dominated by China, with a share of about 90 %. The country’s total production capacity is estimated at 300,000 tonnes of NdFeB magnets per year.

Consumer electronics, electric mobility (cars, scooters, etc.), and wind power generation are the industry sectors that consume most of the permanent rare-earth magnets. Experts agree that electric mobility and wind generation will be primary drivers of demand.

“With this large-capacity permanent rare-earth magnet production, we will fully supply Russian high-tech companies with top-quality magnets to achieve development goals for the domestic wind power and mechanical engineering industries, including the automotive industry,” Rusatom MetalTech CEO Andrey Andrianov said at Atomexpo 2024.

Rosatom is present in both of these segments. The wind power division of the Russian nuclear corporation builds wind farms in Russia. This March, the second 35 MW phase of Rosatom’s Trunovskaya Wind Farm in the Stavropol Krai was connected to the national power grid. Consisting of 38 wind turbines, Trunovskaya has a total installed capacity of 95 MW. This is the ninth wind farm commissioned by Rosatom; their aggregate capacity exceeds 1 GW.

Rosatom is also engaged in electric mobility. Its subsidiaries are developing a complete electric drive system, which consists of an electric motor, a gearbox and an inverter placed into a single housing. “We are upgrading chemical processes at our lithium production and developing our own batteries, electric drives and other components. While setting up the production of all key components, Rosatom is not going to become an electric car manufacturer at this time. But we call on all automakers to consolidate efforts and saturate the market with as many components as needed to make Russian-made electric cars competitive in price,” TVEL President Natalya Nikipelova said at Atomexpo 2024.