Energy Sector 2050: Russian Forecast

back to contentsThe Russian Energy Agency (REA) under the Russian Ministry of Energy has released its Global Energy Development Scenarios 2050 report (the Scenarios 2050). The first global energy forecast published by Russian experts in a long time, it presents the simulation results based on three scenarios.

The Scenarios 2050 report was encouraged by several trends persisting in the market. First, the carbon footprint reduction by the global energy sector has dominated the public and political discourse in recent years. Second, the range of expert assessments regarding the energy market evolution has been extremely wide. For instance, the natural gas consumption in 2050 is estimated to vary from 500 bcm to as much as 8 tcm, while the forecast share of renewable energy sources differs by 71 percentage points (from 13 % to 84 %).

“We see the need to shape our own vision of the future, which would reflect every aspect of the global energy development and national priorities of both Russia and other countries,” explains REA Director Alexey Kulapin in his foreword to the report. According to him, the approach adopted for the scenario design process relies on unbiased research, leans towards no foregone conclusions, and diversifies forecasts with various hypotheses regarding the choice of generation technology, sources of energy, and fuels.

The Scenarios 2050 assume that decarbonization has become an imperative for the global energy sector. But while the goal is clear, the pathways to it vary. Many carbon reducing technologies are still at an early stage of development. What is more, the cost of achieving carbon neutrality by 2050, as aimed by the Paris Climate Agreement, exceeds 6 % of the global GDP, thus taking resources away from the other Sustainable Development Goals. As the report notes, earlier scenarios do not fully account for the costs to be borne.

The REA report considers three scenarios: Business as Usual (BAU), Rational Technology Choice (RTC), and Net Zero (NZ). Each of them is developed for 11 macro regions, Russia included. The baseline is 2022, while the charts are structured by decade, starting from 2000.

General outlook

Overall, consumption of primary fuels and energy resources from 2022 till 2050 will increase globally by 37 % (to 18.6 btoe) in the BAU scenario and 15 % (to 15.7 btoe) in the RTC scenario, while decreasing by 9 % (to 12.4 btoe) in the NZ scenario.

CO2 and methane emissions from the use and production of energy resources will increase by 26 % (to 42 billion tCO2eq) in the BAU scenario, decrease by 34 % (to 21.9 billion tCO2eq) in the RTC scenario, and drop by 74 % (to 8.6 billion tCO2eq) in the NZ scenario by 2050.

One of the clearly visible trends is the rapid growth of electricity and hydrogen consumption. Electricity consumption will grow by 87 % (to 3.8 btoe) in the BAU scenario, 2.3 times (to 4.9 btoe) in the RTC scenario, and 2.5 times (to 5.4 btoe) in the NZ scenario by 2050.

An unambiguous trend emerges for almost all primary fuels and energy resources: coal, liquid hydrocarbons, gas and biofuels will be the highest consumed fuels in the BAU scenario, and the lowest in the NZ scenario. The opposite is true for hydro, wind and solar power.

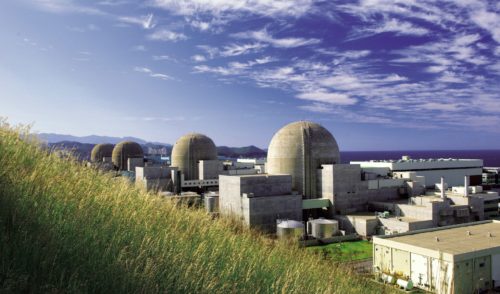

Nuclear power forecast

There is no unambiguous trend for nuclear power, the report says. Thus, the consumption of power generated from nuclear sources in 2050 will amount to over 1.17 btoe in the BAU scenario, almost 1.13 btoe in the RTC scenario, and about 1.93 btoe in the NZ scenario. If compared with 2022 (0.7 btoe), the growth is registered in any scenario. In the period from 2022 till 2050, global nuclear power generation will increase by 56 % in the RTC scenario and by as much as 166 % in the NZ scenario. In 2050, demand for nuclear power in the NZ scenario will exceed that in the RTC scenario by 71 %.

“The reason why the nuclear power consumption in the BAU scenario is higher than in the RTC scenario lies in the financial constraints that we have taken into account for the RTC scenario. It should be remembered about rather high specific costs of nuclear new build. Since there are no such constraints in the RTC and NZ scenarios, the forecast of nuclear generation is higher. We did not take this factor into account in the BAU scenario — it is not necessary if the energy sector develops in the next 28 years in the same way as it used to in the previous 20. There are no restrictions in the NZ scenario because the energy system needs to be balanced with a very high share of intermittent renewable energy sources,” Vladimir Drebentsov, Chief Advisor to REA Director, commented to Rosatom Newsletter.

When viewed by region, the RTB scenario foresees China, which will sharply increase its capacity, to have the largest share of nuclear power generation. The USA and Canada will come second, with nuclear generation projected to grow notably. The European Union and the United Kingdom, in which the growth is also expected, will take the third place. Nuclear generation will grow significantly in India and emerge in the EAEU countries. Besides, new capacity will be added in the countries of Sub-Saharan Africa. There will be a slight increase in nuclear capacity in Latin America. As for Russia, nuclear generation in 2030–2050 will remain virtually unchanged, increasing from 49.9 thousand toe to 51.4 thousand toe. Total nuclear generation in this scenario will amount to 0.8 btoe in 2030 to grow slightly above 0.9 btoe by 2040.

The NZ scenario sees the proportions changing. Other Asia (i. e., countries outside China, India and the Asian part of the EAEU) will account for most of the new capacity growth and nuclear generation. Sub-Saharan Africa, Middle East and North Africa, India and Russia will demonstrate a more sizable growth. In Russia, nuclear power generation will reach 60.87 thousand toe in 2030, 93.5 thousand toe in 2040, and 120 thousand toe in 2050. Total nuclear generation in this scenario will amount to 1 btoe in 2030 and almost 1.44 btoe in 2040.

General conclusions

Almost every forecast to which the authors of the Scenarios 2050 compared their findings also considers at least three long-term scenarios for the global energy sector development. Typically, the set of scenarios is very similar and includes an equivalent of BAU, RTC (commonly referred to as a scenario of reforms or accelerated reforms), and NZ (achieving carbon neutrality by 2050). The authors of the report believe that the very unanimity in considering such extremely different scenarios indicates that specific ways of decarbonizing the global energy sector have not been defined yet. This uncertainty becomes particularly clear when comparing similar scenarios in different forecasts. Nevertheless, some trends can be discussed with a reasonable degree of certainty.

The growing occurrence of climate change effects leaves no way to stop the energy transition even in the most unfavorable years for energy markets — such as now, for example. Therefore, the BAU scenario is most unlikely to come true.

On the other hand, the authors of the Scenarios 2050 have strong doubts about the feasibility of the NZ scenario. “Although the goal of achieving carbon neutrality by 2050 is very attractive, the required investments outweigh the capacity of the global economy and might create significant obstacles to achieving no less important goals of social and economic development (including UN SDG 7),” says the report.

The Russian experts believe that a less radical transformation of the global energy sector is more likely than that described in the NZ scenario. It is beginning to take shape already now. A noticeable increase in the final consumption of electricity will affect every sector, including transportation, housing, utilities, and industry. The role of hydrogen and advanced biofuels in the final consumption will also increase, although on a smaller scale. There is no doubt that the share of electricity from renewable energy sources will grow, too. However, the mounting number of grid balancing and baseload shortage problems on the back of a rising share of renewables and a noticeably higher capital intensity of renewable sources combined with a much shorter lifetime of wind and solar farms will maintain the need for conventional power generation. This is where carbon-free nuclear power plants will play an important role. However, gas-fired and even coal-fired power plants will continue to contribute to power production.

According to the authors of the Scenarios 2050, hydrogen will remain one of the most expensive decarbonization methods. Its use will increase mainly in those processes that do not have less costly options of carbon footprint reduction.

Since it is not economically feasible to replace conventional carbon-based energy sources too radically with carbon-free generation, it is necessary to increase the absorption capacity of ecosystems, the Russian experts believe. This includes such technologies as direct capture of carbon dioxide from the atmosphere and oceans. These measures will ease the burden of hard-to-solve problems of international climate finance in developing countries, according to the authors of the report.

Another important consequence of the energy transition is that the lower demand for fossil fuels will reduce global trade. Trade in new energy resources will not compensate for the loss of trade in conventional fuels, especially oil, which is now many times larger than trade in any other natural resource.

Finally, the Russian experts estimate the probability of commercializing breakthrough technologies (thermonuclear fusion, energy transfer from the Moon, etc.) as not equal to zero, but extremely low.