SMR Dashboard

back to contentsThe OECD Nuclear Energy Agency (NEA) has released the second edition of its Small Modular Reactor (SMR) Dashboard. This document outlines advancements in SMR technologies and organizes the data across multiple dimensions. While the SMR Dashboard could serve as a valuable reference for investment managers, it should be noted that there are significant inaccuracies concerning Russian SMR projects and technologies, which are leading in this field. Therefore, caution is advised when using this resource for investment decisions.

For the second edition of the Small Nuclear Reactor (SMR) Dashboard, NEA experts identified 98 SMR technologies around the world, but only 56 of them were analyzed: “These are the SMRs for which the requisite publicly available information was assessable and for which the relevant designers were willing to participate.” The remainder include SMR technologies that are not under active development, may be without human or financial resources, or have been canceled or paused indefinitely. The assessments in the latest edition of the SMR Dashboard are based on progress up to a cutoff date of 10 November 2023.

The SMR data in the document is structured along several dimensions, including progress from concept towards commercial deployment, siting by country, site owners, fuel enrichment requirements, type of coolant, applications, and additional features.

Dive into methodology

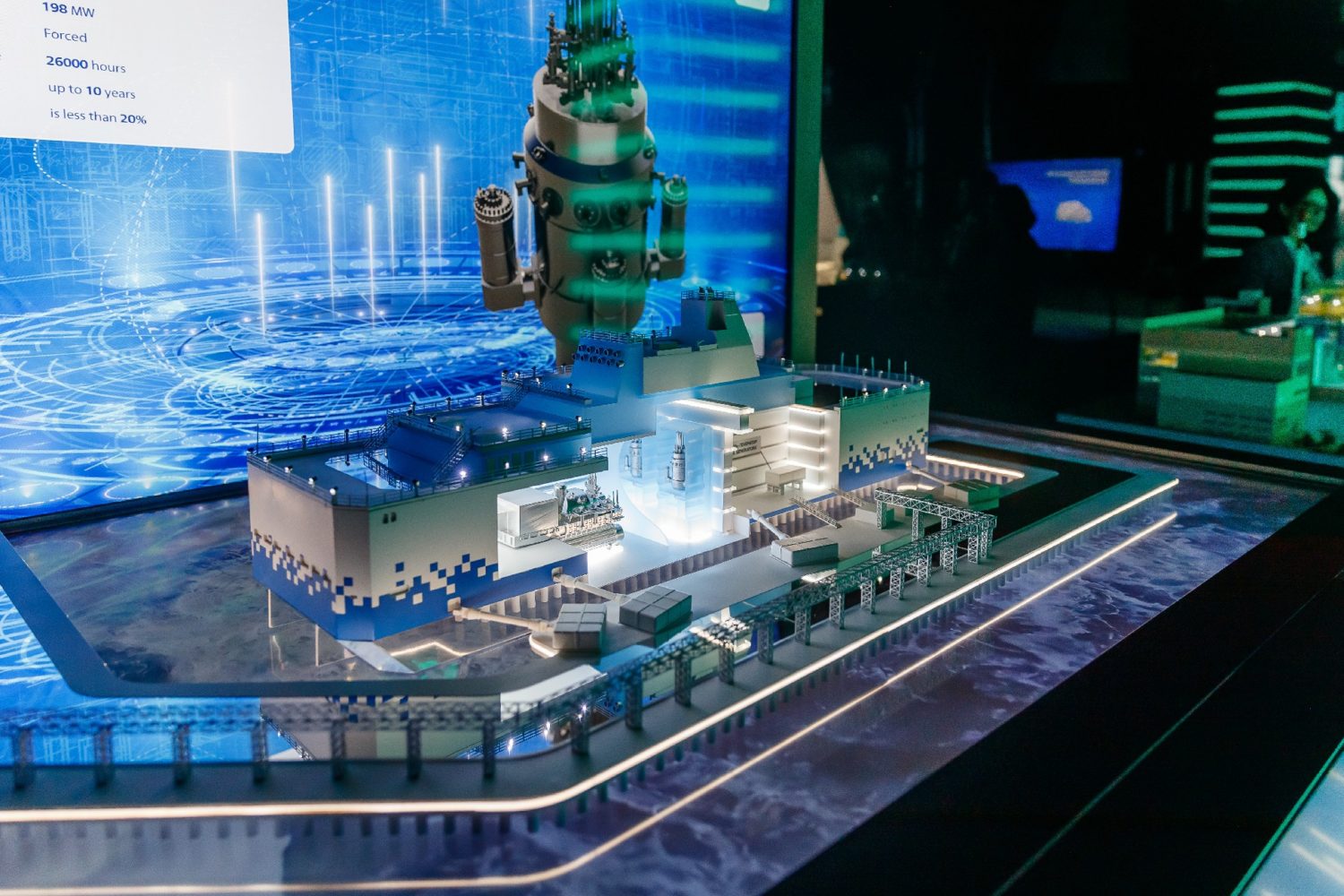

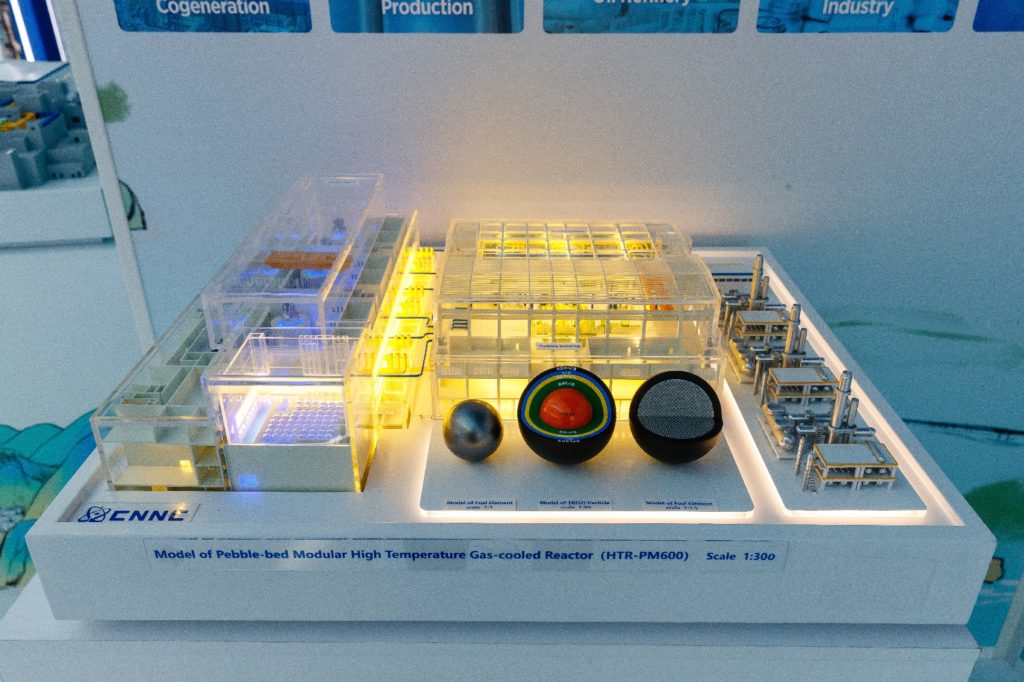

The number of the SMRs in operation is the first thing that surprises an attentive reader: “There are three SMRs deployed and operating: the HTR-PM in China, the floating KLT 40S in Russia as well as the High Temperature Test Reactor (HTTR) in Japan.” The latter is, however, a research reactor, and research reactors are usually not referred to as SMRs — only power generation installations, including demonstration reactors, count as such. If the authors took the liberty of including them into the SMR ranks, they should at least have taken into account the MBIR multi-purpose fast-neutron research reactor which Rosatom is building in Dimitrovgrad (Russia), with interested parties invited to join the research program.

The mention of merchant ships as yet a potential application for the SMR technology also raises questions. What, then, about Sevmorput, the world’s only nuclear-powered lighter carrier owned by Rosatom? It operates on the Northern Sea Route and delivers cargoes to destination ports.

Russian-designed RITM 400 reactors are not mentioned in the document either. The first of them will be installed on the Rossiya icebreaker of the Leader Project family. Production of the core equipment and control systems for the reactors has already begun. Discussions are underway to build an onshore modification of the RITM 400 reactor to supply power to the production facilities of the Russian mining giant Nornickel. The parties have entered into an agreement of intent and cooperation.

Finally, and most importantly, the SMR Dashboard does not mention the onshore small-scale nuclear power plant with the SHELF-M reactor, which is being developed by the Dollezhal Research and Development Institute of Power Engineering (NIKIET, part of Rosatom). Rusatom Overseas CEO Evgeny Pakermanov said at the Atomexpo 2024 forum that the front-end engineering phase for the SHELF design was completed, and so were a number of research and development programs related to the application of this technology. Since the deployment region (Chukotka) and the largest consumers have also been identified, the decision to launch the SHELF project is expected to be made later this year. The nuclear power plant with the SHELF-M reactor will supply power to the Sovinoye gold deposit and adjacent areas in Chukotka.

It should be also noted that, for some reason, the NEA SMR Dashboard calls NIKIET to be an independent developer of the BREST-OD 300 reactor. It is, however, a subsidiary of Rosatom. Speaking generally, Rosatom is working on no less than ten SMR designs, each at a different stage of completion.

Assessment circle

The authors use a circle divided into six concentric rings and six sectors to assess progress of each SMR design. Every sector captures a specific assessment dimension. Licensing is the first of them: “The criteria for assessing progress in licensing closely follow international licensing norms, including pre-licensing interactions with regulators, design approval, construction and the issuance of operating licenses. A bonus is given to SMRs with licensing activities in multiple jurisdictions at any level.”

Siting is the second dimension: “The criteria for assessing progress in siting reflects decisions by site owners and considers licensing readiness of sites for SMR construction. A bonus is given to SMR technologies making progress at multiple sites at any level.”

Financing is the third: “The criteria for the financing assessments reflect both public announcements from reactor designers and financing reports from publicly available sources.”

Supply chain readiness is the fourth: “The criteria for assessing progress in supply chain readiness consider increasing levels of commitment reflected in memoranda of understanding, binding contracts, and formal partnerships, joint ventures or consortia with suppliers or engineering, procurement and construction companies.”

Engagement is the fifth: “The criteria for engagement reflect the number of engagements with people and communities associated with the SMR project, evidenced by memoranda of understanding, endorsements, town hall meetings or benefit-sharing agreements.”

Fuel is the sixth: “The criteria for assessing progress on fuel are based on progress towards the commercial supply of qualified fuel. Once a licensed and operating fuel fabrication facility exists for fuel, it is considered alongside others already being used in operating plants. For SMRs at this level of maturity, the next stages include contracts for fuel supply and a license to operate the reactor with the specific fuel.”

The above criteria do cover the key assessment dimensions and are capable of tracking progress in different SMR designs, but the metrics are questionable. For example, should a bonus be definitively given to SMR technologies making progress at multiple sites at any level? An example of Westinghouse might be recalled in this connection. The company failed to finish the simultaneous construction of large reactor units at two sites, so the Virgil C Summer project was suspended.

Licensing activities in multiple jurisdictions as a bonus also look ambiguous if we recall a scandal over NuScale. The company applied to obtain a license for one design but proposed to build another one, which it planned to license later. Last November, the plans to build the US’ first small modular reactor at the Idaho National Laboratory were canceled and NuScale was accused of providing misleading information. NuScale’s claim to build SMRs in other countries is at least unethical in this context.

The engagement criteria are also questionable. The highest score is given if there is “evidence of ten or more engagement activities with civil society.” First, it is not clear why ten. Second, it is not clear what counts as an engagement activity. The document reads as follows: “Engagement activities in mainstream, non-nuclear media through videos, podcasts or interviews will be considered as well as memoranda of understandings, endorsements, town hall meetings and benefit-sharing agreements from the following stakeholder groups: national governments, subnational governments, indigenous governments, labor unions, non-governmental organizations, civil society organizations, community organizations, universities, end users and customers, and advisory boards.” Here is an example: an Orthodox church was built in Pevek (Russia) with support from the world’s first floating nuclear power plant, Akademik Lomonosov. Should this be counted as one or several engagement activities?

We should also point out that the wording “no recent information was readily available from verifiable public sources related to engagement activities” with regard to the BREST-OD 300 design is inconsistent with reality. BREST-OD 300 is being built in the premises of the Siberian Chemical Plant (SCP), which is part of Rosatom’s fuel division, so the depth of engagement should be measured by taking into account the activities of both companies — at least in Seversk where the plant is located. Considering the engagement of BREST-OD 300 separately from SCP or Rosatom’s fuel division is as senseless as trying to measure the engagement of each individual reactor of a multi-reactor nuclear power plant. It should be noted that Seversk is a company town, so the SCP engagement in community life has been at the maximum level for many decades.

Waste wizard

NEA proposed a joint project on waste integration for small and advanced reactors: “The NEA Joint Project on Waste Integration for Small and Advanced Reactor Designs (WISARD) aims to take advantage of the present unique window of opportunity to integrate waste management from the beginning of the SMR and AR design life cycle <…> The dedicated NEA WISARD platform will facilitate the collaboration and understanding between stakeholders throughout the plant life cycle, which will be the key to building a successful, sustainable program.” The idea of building such a platform is certainly interesting, useful and promising. But if the platform membership is limited to OECD countries, other nations will likely develop their own SMR waste management systems or set up a similar platform within another association, such as BRICS, for example.

For now, SMR waste management is at the initial stage of development, as the Dashboard says: “There was insufficient available information from verifiable public sources to assess the progress of SMRs in terms of waste management planning and readiness for end-of-life cycle management. Work on future editions of the NEA SMR Dashboard is expected to include the development of a methodology and criteria for assessing progress in this area.”

Introduction to SMRs

If the information on Russian designs were correct, the SMR Dashboard could be recommended to financial managers willing to learn more about the progress in SMR technology, to compare existing SMR designs across several benchmarks, and to approximate an answer to the question of whether it is worth investing in a certain technology or design. The document emphasizes three key advantages of nuclear power generation, which Rosatom representatives have been talking about for many years at different venues: contribution to decarbonization, stability of pricing, and production of electricity. “SMRs will have an essential and increasingly important role to play supporting decarbonization targets,” the authors of the SMR Dashboard write with confidence.

They also name the challenges faced by nuclear energy, which include delivering nuclear projects on time and on budget, unlocking access to significant amounts of capital at competitive rates, ensuring a healthy and resilient supply chain, and ensuring a skilled workforce.

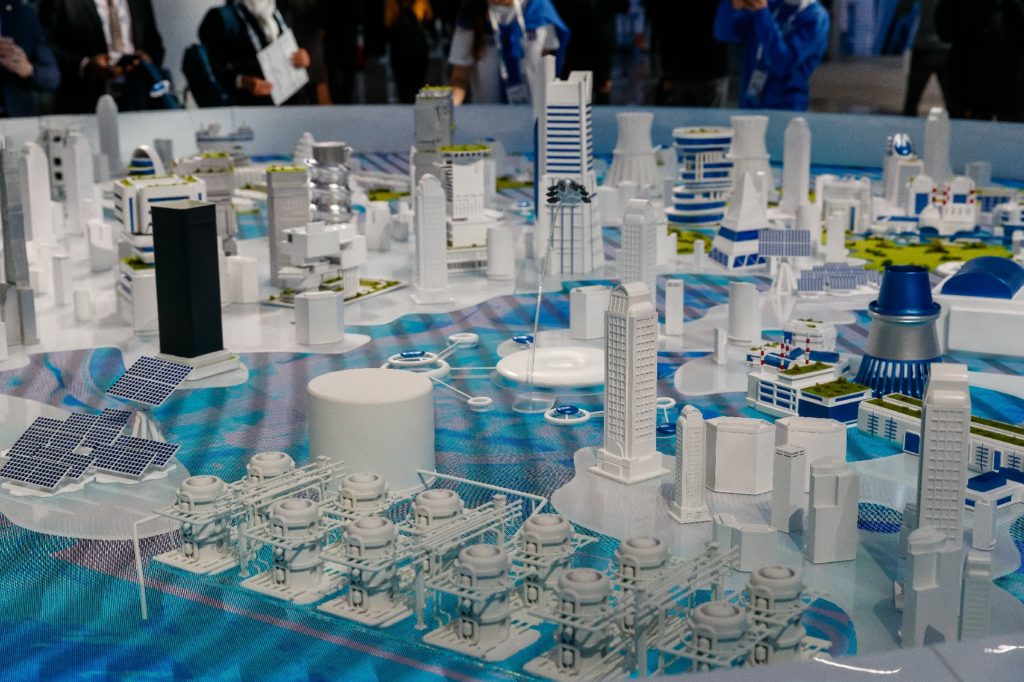

This highlights the advantages of SMRs: due to their smaller size, they are safer, easier to build, and cheaper in absolute terms. In addition, they are easier to integrate into the existing grids, have more deployment options, and often have potential for additional applications, such as production of heat (as in Akademik Lomonosov) and isotopes.

The authors are sure that the SMR technology has two windows of opportunity. First, “SMRs and advanced reactors with high levels of readiness will play a central role in getting to net zero by 2050 by supporting decarbonization efforts that are expected to gain pace in the 2030s and 2040s.” Second, “SMRs and advanced reactors currently with lower levels of readiness could be deployed at scale from the 2040s to supply electricity, heat and hydrogen, and could contribute to long-term sustainability with advanced nuclear fuel cycles.”